October 20, 2022

By: Gwenneth O’Hara and Samir Hafez

On September 21, 2022 the California Energy Commission (CEC) issued its draft report of the Lithium Valley Commission, which includes 44 recommendations concerning the opportunities and challenges associated with the expansion of geothermal energy production and lithium extraction in the Salton Sea region. Stakeholders should have a clear understanding of the current limitations on development in the region and the policies that may impact potential operations and investments. The period for public comment to the CEC on the draft report’s findings and recommendations closes on October 28, 2022. Following the close of public comment, the report will be submitted for consideration by the state legislature and policy makers. The report lays out the following key points:

- World demand for lithium is expected to grow as much as tenfold in the next decade, but virtually none is produced in the United States.

- Officials at the local, state, and national level identify the Salton Sea geothermal resource area, located within Imperial County, California, as well-positioned to become a competitive source of lithium that could satisfy more than one-third of today’s worldwide lithium demand.

- The opportunity for increased geothermal energy production and lithium production in California has the potential to unleash billions of dollars of new economic infrastructure development.

- The draft report of the Lithium Valley Commission identifies 44 recommendations for regulatory and legislative approaches to incentivizing geothermal power, lithium recovery, and infrastructure development while mitigating economic, environmental, and community impacts.

- It will be crucial for project developers and other industry participants looking to take part in the Lithium Valley transformation to closely monitor related legal and regulatory developments and strategically engage in relevant stakeholder processes.

Lithium Key to National Security and Economic Prosperity

Lithium is a core component of the batteries that power most electric vehicles (EVs) and energy storage technologies—both of which are important to achieving air quality and climate change goals. Although the United States (U.S.) has large lithium reserves, domestic extractions currently account for a negligible amount of global lithium supply. Instead, Australia, Argentina, Chile, and China account for the majority of the world’s supply. Global demand is forecast to grow as much as tenfold in the next decade, and could soon outpace supply. Due to the high demand for and reliance on lithium-ion batteries in the U.S. and the world, lithium is seen as a critical mineral important to national security and economic prosperity. To meet this demand, federal and state policies are aiming to enhance U.S. lithium supply capabilities.

Salton Sea Known Geothermal Resource Area

One major target of these policies is the Salton Sea “known geothermal resource area” (KGRA), as defined by the Geothermal Steam Act of 1970. The Salton Sea KGRA features geothermal brines stored in reservoirs far below the floor of the Salton Sea in Imperial County, California. These brines contain an estimated 2-6 million metric tons of lithium—thought to be the highest concentration of lithium in geothermal brines in the world. A CEC funded research project conducted by SRI International found that the Salton Sea KGRA can produce more than 600,000 tons per year of lithium carbonate if fully developed.

Intersection of State Priorities

In addition to meeting domestic lithium demand, expanding lithium extraction in the Salton Sea KGRA can help to serve two of California’s top priorities: encouraging new battery technology for electric cars and storage and increasing sources of firm, renewable energy. This is due to the fact that technology used to extract lithium from the Salton Sea KGRA relies on existing and new geothermal power plants, which satisfy state mandates for the procurement of baseload renewable resources.

Direct Lithium Extraction (DLE) involves recovering lithium from geothermal brine after the mineral moves through pipelines and tanks at a geothermal power plant. The draft report indicates that DLE is considered to be the more sustainable and environmentally superior approach as compared to traditional hard rock mining or evaporation mining techniques. Since DLE relies on geothermal power plants to bring the brine to the surface, the amount of lithium recovered corresponds to the amount of brine flowing through the power plants.

Some estimates indicate that current geothermal power capacity at the Salton Sea KGRA is able to support recovery of roughly 127,000 metric tons of Lithium Carbonate Equivalent (LCE). For comparison, current global production of lithium primarily through mining and evaporation ponds in 2020 was less than 100,000 tons, but is expected to increase significantly.

CEC data shows that there are currently 10 geothermal power plants producing electricity in the Salton Sea KGRA with a total installed nameplate capacity of approximately 414 megawatts (MW). Experts estimate the area’s geothermal resources are robust enough to support development of 6 times the current capacity—between 2,330 and 2,950 MW. As noted below, however, the region does not generate sufficient local demand to utilize that much power, and significant infrastructure upgrades will be needed to export increased geothermal energy to other regions.

Assembly Bill 1657 and the Future of Lithium Valley

In 2020, Governor Gavin Newsom signed Assembly Bill 1657 (AB 1657, E. Garcia,

Chapter 271, Statutes of 2020) into law with the vision of turning the Salton Sea region into “Lithium Valley;” a world-class lithium industry centered on lithium extraction and geothermal energy production and creating local economic and community development opportunities.

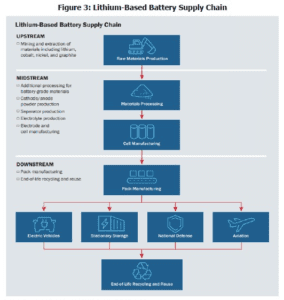

Beyond lithium extraction and power plants, officials also envision establishing a cluster of the lithium-related industries within the region. Figure 3 of the draft report reflects the various types of operations along the lithium supply chain:

Source: Federal Consortium for Advanced Batteries. June 2021. “National Blueprint for Lithium Batteries 2021-2030: Executive Summary.” U.S. Department of Energy. DOE/EE-2348. Page 17.

Lithium Valley Commission Report

Pursuant to AB 1657, the CEC established the Blue Ribbon Commission on Lithium Extraction in California (Blue Ribbon Commission or Commission) to review, analyze, and investigate specific topics relating to lithium extraction in California and to submit its findings and recommendations to the state legislature. The draft report is the culmination of these efforts, and some of the 44 recommendations across eight issue areas include:

- Geothermal energy development for lithium recovery

- Market opportunities

- Electricity grid benefits

- Technical and economic challenges

- Safety and environmental protection

- Economic benefits and environmental impacts

- Local, state, and federal incentive and investment opportunities

- Legislative or regulatory changes

The draft report characterizes Lithium Valley development as a “once-in-a-generation opportunity with tremendous potential for transformative economic growth that could bring family-sustaining jobs and real economic opportunities to California’s most underserved residents.” The draft report also makes clear, however, that the path to Lithium Valley is not without its challenges.

Amongst other things, the Commission recommends increased funding and incentive structures to promote investment in local communities and infrastructure and various regulatory safeguards to address environmental and community concerns. The report provides findings and recommendations for resources, health impact assessments, information sharing, planning, procurement, infrastructure, project labor agreements, community benefits agreements, oversight, monitoring, and Tribal and community engagement. Appendix A to the draft report lists all recommendations by topic.

The public comment period, which is open until October 28, 2022, allows for interested stakeholders to provide their input on the report and suggest any revisions. As the legislature and state and federal agencies move forward with Lithium Valley efforts, stakeholders will have additional opportunities to comment on and help shape applicable rules and regulations.

The remainder of this update highlights the draft report’s findings and recommendations concerning development of geothermal power facilities. Understanding these recommendations, and how they implicate related laws and regulations, will be key for geothermal project developers and related stakeholders involved in the region.

Support for Further Development of Geothermal Power Facilities and Benefits to the Electric Grid

The draft report identifies the following electricity system benefits of geothermal power plants:

- Grid stability. The rotating mass of steam-powered electricity generators in geothermal power plants helps the local electricity system absorb short-term fluctuations, such as sudden stops and starts of intermittent electricity resources

- Grid reliability. Geothermal power plants provide a sustainable and stable source of electricity and are characterized as a baseload renewable resource. Salton Sea KGRA geothermal power plants are designed to operate best at a constant level rather than ramping up and down to follow load

- Grid resiliency. If the electricity grid goes down, geothermal power plants in Imperial Valley are designed so that they do not turn off completely. The geothermal heat is still there and can keep generating electricity, even if the grid goes down, which enables geothermal power plants to help restart the grid

An important point made in the report is that development of the Salton Sea geothermal resources has been particularly difficult and costly due to the high salinity and mineral content of the brines. However, with the addition of DLE, that problem has turned into an opportunity and created an additional source of revenue for geothermal facilities. The addition of other mineral recovery will add additional sources of revenue for the facilities.

In addition to costs, the report acknowledges that transmission infrastructure limits the rate of geothermal energy project expansion in Imperial Valley. Geothermal facility developers and operators will need to account for these transmission limitations and the potential for delays to project start dates and deliveries

More than 900 MW of new geothermal power plants within Imperial Valley are in the Imperial Irrigation District (IID) interconnection queue. Although the Salton Sea KGRA is in the IID balancing authority area, much of the electricity generated from new geothermal power plants is expected to be exported outside IID to the California Independent System Operator (California ISO or ISO) balancing authority area and the western electricity grid. Existing transmission paths cannot export significant amounts of new geothermal energy to these areas.

To address limitations, IID has proposed new transmission lines for new installed capacity, including an interim solution (up to 1,750 MW of export) and a long-term solution (up to 3,000 MW) to support geothermal energy exports. In addition, the Governor’s 2022-23 budget packet authorizes the California Infrastructure Bank (IBank) to finance clean energy transmission projects under its Climate Catalyst Revolving Loan Fund, which can support development of transmission for the region. Resource and transmission planning processes at the California Air Resources Board (CARB), CEC, California Public Utilities Commission (CPUC), and ISO, are also taking the potential for new geothermal power plants in Imperial Valley into consideration.

State procurement mandates will also play a key role in incentivizing and supporting expanded geothermal project development. The CPUC issued its decision D. 21-06-035 in June 2021 to address mid-term reliability concerns related to the retiring of the Diablo Canyon Power Plant. In that decision, the Commission ordered load serving entities to procure a total of 11.5 gigawatts (GW) of capacity from new, zero-emitting resources to come online between 2023 and 2026. At least 1 GW of that procurement must come from clean, firm resources, such as geothermal. As the state continues to grapple with reliability concerns due, in part, to the increased use of intermittent resources, the CPUC may consider requiring LSEs to procure a greater share of capacity from geothermal resources.

Given the potential grid benefits and limitations, the draft report makes the following recommendation for actions to support further development of geothermal power in the Salton Sea region:State transmission planning entities and local utilities should pursue making investments for transmission upgrades to address transmission needs for geothermal energy delivery from the Imperial Valley area over the next 10 years. Planning should consider developers’ plans to begin bringing new geothermal power plants on-line in 2024 with collocated DLE from geothermal brine. These efforts will support the expansion of geothermal energy to provide electricity and ancillary services to the electricity grid from a firm, renewable energy resource

As demonstrated above, the state has a clear interest in furthering geothermal energy project development in the Salton Sea area and addressing limitations through legal and regulatory mechanisms across several agencies. Developers and other stakeholders must closely monitor these agency efforts to understand how certain changes may impact the timeliness and commercial feasibility of their projects and how to account for these changes in their commercial agreements. In addition, interested parties should be prepared to strategically engage in stakeholder processes surrounding the development of these rules to ensure that their interests are adequately represented.

The draft report is available on the CEC’s Lithium Valley Commission docket page at: https://www.energy.ca.gov/data-reports/california-power-generation-and-power-sources/geothermal-energy/lithium-valley

Buchalter’s Energy practice group regularly monitors legal and regulatory updates and represents stakeholders’ interests in various state and federal regulatory proceedings and transactions involving these resources. If you have any questions please contact one of the authors below.

This communication is not intended to create or constitute, nor does it create or constitute, an attorney-client or any other legal relationship. No statement in this communication constitutes legal advice nor should any communication herein be construed, relied upon, or interpreted as legal advice. This communication is for general information purposes only regarding recent legal developments of interest, and is not a substitute for legal counsel on any subject matter. No reader should act or refrain from acting on the basis of any information included herein without seeking appropriate legal advice on the particular facts and circumstances affecting that reader. For more information, visit www.buchalter.com.